Driving without valid insurance in Illinois is a common violation that can lead to hefty fines, license suspension, and complications with the Secretary of State (SOS). As an Illinois reinstatement lawyer based in Joliet, with over 20 years of criminal law experience, I've helped many clients in Will County navigate these issues to regain their driving privileges. Under 625 ILCS 5/3-707, operating a vehicle without mandatory liability insurance (25/50/20 minimum) triggers penalties, while uninsured accidents can result in financial responsibility suspensions if you're at fault. In 2025, enforcement remains strict to ensure road safety, with no major law changes but ongoing emphasis on compliance. Whether from a traffic stop or crash, these violations can escalate to misdemeanors if causing injury, leading to jail time, vehicle impoundment, and extended suspensions—early legal intervention can mitigate fines, avoid criminal records, and expedite reinstatement.

Driving without valid insurance in Illinois is a common violation that can lead to hefty fines, license suspension, and complications with the Secretary of State (SOS). As an Illinois reinstatement lawyer based in Joliet, with over 20 years of criminal law experience, I've helped many clients in Will County navigate these issues to regain their driving privileges. Under 625 ILCS 5/3-707, operating a vehicle without mandatory liability insurance (25/50/20 minimum) triggers penalties, while uninsured accidents can result in financial responsibility suspensions if you're at fault. In 2025, enforcement remains strict to ensure road safety, with no major law changes but ongoing emphasis on compliance. Whether from a traffic stop or crash, these violations can escalate to misdemeanors if causing injury, leading to jail time, vehicle impoundment, and extended suspensions—early legal intervention can mitigate fines, avoid criminal records, and expedite reinstatement.

Understanding Driving Without Insurance Violations

Illinois requires all drivers to carry proof of insurance at all times. If stopped without it, you face immediate penalties, and failure to provide proof within 30 days worsens the case. Common scenarios include routine traffic stops or accidents where lack of insurance is discovered. For 2025, the SOS mandates electronic verification, speeding up detections. If the violation leads to an accident with damage over $500 and you're at fault without insurance, it triggers a financial responsibility suspension until the judgment is satisfied or insurance is proven retroactively.

Penalties for Driving Without Insurance in 2025

Penalties include:

- First Offense: Minimum $500 fine, up to $1,000 if plates suspended for prior violation; 3-month license suspension; $100 reinstatement fee.

- Repeat Offenses: Fines up to $1,000, 4-6 month suspension, vehicle registration suspension requiring valid insurance to reinstate.

- With Injury or Death: Class A misdemeanor (up to 1 year jail, $2,500 fine) or Class 4 felony (1-3 years prison, $25,000 fine); longer revocations.

- Vehicle impoundment costs add up, and insurance rates skyrocket. In Will County, including Joliet, courts impose these to deter uninsured driving, with additional assessments.

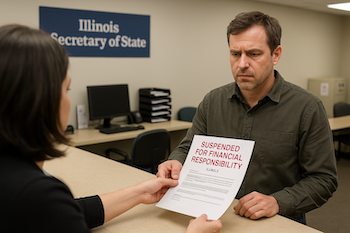

Financial Responsibility Suspension and Its Impacts

Financial responsibility suspension occurs after an uninsured accident where you're at least 50% at fault with damage over $500. The SOS suspends your license until you post security (e.g., bond for potential judgment) or prove insurance coverage at the time. In 2025, administrative suspensions for uninsured crashes carry a $70 reinstatement fee per suspension. Impacts include inability to drive legally, potential civil judgments, and criminal charges if driving during suspension. For out-of-state residents, this affects clearance letters.

Reinstatement Process After Suspension

To reinstate:

- Pay fines and fees ($100 for general suspensions, $70 for administrative).

- Provide SR-22 certificate for 3 years, proving high-risk insurance.

- Submit proof of insurance and any required documents to the SOS.

- For revocations from related DUIs, attend hearings with evaluations.

In 2025, use the SOS online portal for payments and submissions to speed up processing (up to 30 days). Denials from incomplete proof can be appealed within 35 days.

Why Hire an Illinois Reinstatement Lawyer for Insurance Violations?

Handling suspensions alone risks prolonged downtime and escalated charges. At Illinois Reinstatement Lawyers, led by Jack L. Zaremba, we specialize in financial responsibility suspensions, SR-22 guidance, and SOS appeals statewide, helping Will County clients avoid pitfalls.

Contact us today for a free consultation at our contact page or call (815) 740-4025. Reinstate efficiently.